Fresh graduates often wonder whether or is a better career choice. Most of them already know the first thing about these two career paths: excellent salaries. Some of them also know that work-life balance is a difficult act in both. Here we go a little beyond popular perceptions to find out what these jobs really involve.

Investment banking vs management consulting Differences in careers, lifestyle, salaries, hours First, a little about both industries and careers. Investment banking (IB) denotes a financial service that creates capital for individuals and organizations, according to one definition.

Investment bankers (i-bankers, or just “bankers”) give investors counsel on market strategies that can minimize their risks and maximize their returns. They provide assistance for mergers, acquisitions, and restructuring. Risk management is a major part of the i-banker job. A management consultant (MC) provides expert advice to businesses on operations, restructuring, and cost reduction.

Feb 12, 2019 - Get a better idea of what investment bankers do each day in this. You might apply that knowledge later on in your professional life. Download this free Before You Decide to Sit for the CFA Program Exam eBook. Download Your Copy. COLLEGE FOR FINANCIAL PLANNING, A KAPLAN COMPANY. Free Resources and Articles; cart. Confidential Information Memorandum (CIM): Example and PDF Download. A confidential information memorandum (CIM) is a document prepared by a company in an effort to. The seller's investment banking deal team plays a large role in the creation and distribution of the CIM.

They are called upon to create strategies to help companies make a turnaround. They look at what their client companies have been doing and suggest what they can do to perform better. MCs deal with different types of problems and, for example, may be called upon to suggest to a marketing team how to improve its product delivery or advise HR people how to create a new health plan for employees. Career paths IB and management consulting (often just “consulting,” here) have similar career paths, says an article on wayup.com.

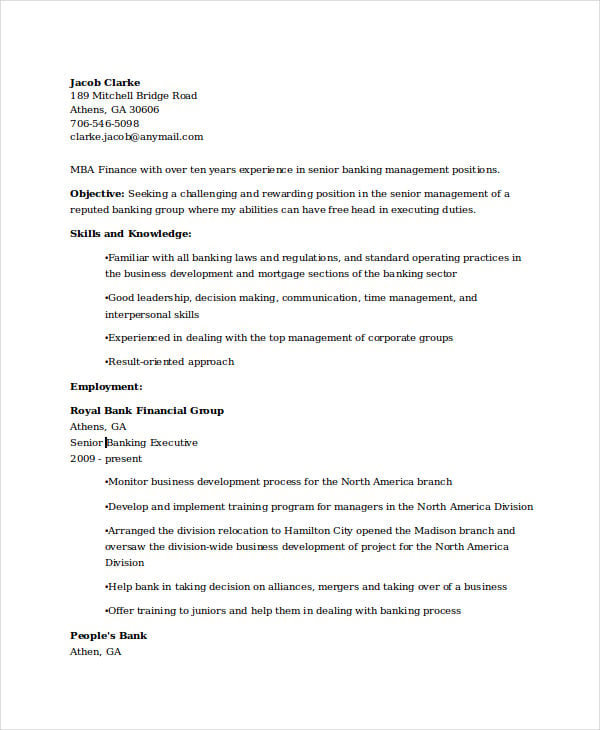

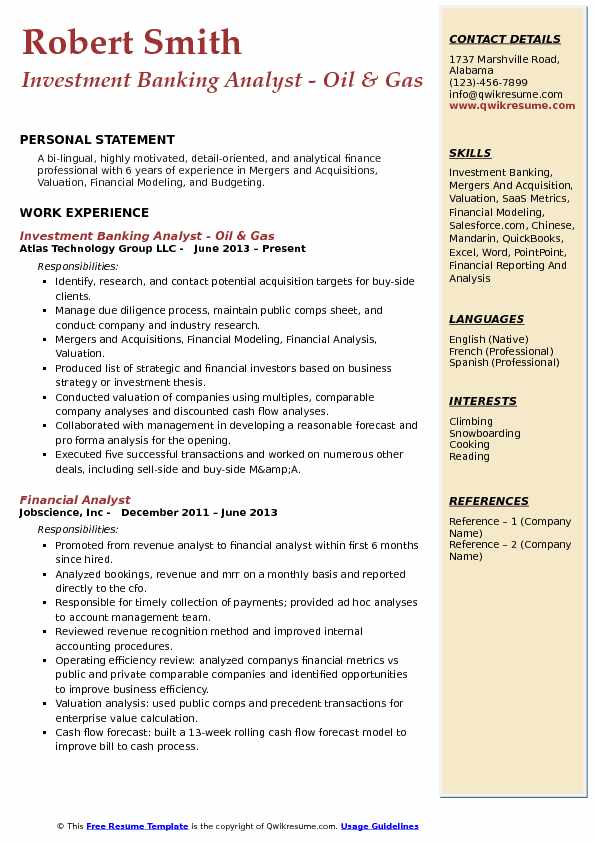

I-bankers start with a summer internship, followed by an entry role as a financial analyst for two years, then, as an associate for two or three years, before elevation as managing director or VP. MCs start their careers as business analysts and gain experience for two or three years before becoming an associate or senior consultant. MCs may not start with an internship as often as i-bankers, since banks do most of their recruitment from among interns. But it is a good idea for MC aspirants to intern to gain industry knowledge. Investment Banking vs Consulting Salaries Salary is probably the biggest attraction that the two careers hold.

At least in the first decade, i-bankers beat consultants in take-home figures. Starting salaries for entrant bankers are $80,000-$150,000 for bachelor-degree holders, while consultants receive $65,000-$100,000. Entry-level consultants with an MBA from a top school can hope to earn $125,000-$200,000, according to Investopedia. But they usually don’t see the big bonuses that go to i-bankers. When bankers and consultants reach partner/managing director position, their salaries may even out at the $500,000 mark, according to wayup.com.

There are a number of salary variables, and I-banker salaries can be at times 50 to 100 percent higher than consultant salaries, says an article in managementconsulted.com. The gap significantly increases higher up the ladder. But the article adds that consulting offers perks including travel allowance. Health and retirement packages could also be better. At the end of the year, bonus comprises 50 percent of annual compensation for bankers.

The pay difference between bankers and consultants in the first year is usually between $30,000-60,000. Skills A couple of skills are common between the two jobs: a number-driven, analytical approach to solving problems and almost preternatural skills in diplomacy. MCs need to understand the management structure of their client companies, identify areas for improvement, and explain what needs to be done to improve their functioning. This means critical-thinking skills, a way with people, the ability to concentrate on business operations, PowerPoint skills, and communications skills. I-bankers need good knowledge of financial modeling and Excel skills and the ability to put in long hours.

Jong manne in ons glorie die girls wou ons nooit glo nie stories gespin, ons was helde daarin soos batman en Robin deur dik en dun rebel en rats ons het gewen en res van ons lewens om te verken en niemand kan ons keer nie of ons nie iets leer nie ons is rebel en rats wingman vir altyd my beste pel saam het ons geval en mekaar op getel. Jing manne in ons glorie niemand wou ons glo nie dinge begin met ons harte daarin vandag is dit die dinge ja die dinge wat tel koor dis ons storie dis ons songen uit volle bors sing ons dit saam as ons paaie in n ander rigting gaan gaan ons storie saam koor.